“India plans to develop at least two public sector banks (PSBs) that can rank among the top 20 global lenders by assets as part of its long-term ‘Viksit Bharat 2047’ vision”,

Times of India – 13th Sept 2025

The above statement came out from the recent meeting that Government of India had with the heads of Public Sector Banks. When we talk about top 20 global banks by assets size, we must know that we are talking big. However, as we are among the top 5 biggest economies in the world, there is no reason why should we not talk about having the biggest banks too. Presently SBI is ranking in 40s as far as asset-based ranking is concerned, still far from the top 20 banks. Incidentally, as per Market Capitalisation standards HDFC Bank is already ranked no 6 and ICICI Bank no 21, however the real ranking is asset wise ranking and we are nowhere among the top players.

First, let us see how long the journey can be to enter into top 20 for Public Sector Banks that are all smaller than SBI. To measure the distance first we will see the size of big Banks on the planet.

| Rank | Bank | Asset Size (billion USD) | Country |

| 1 | Industrial and Commercial Bank of China | 6303.44 | China |

| 2 | Agriculture Bank of China | 5623.12 | China |

| 3 | China Construction Bank | 5400.28 | China |

| 4 | Bank of China | 4578.28 | China |

| 5 | J P Morgan Chase | 4002.81 | US |

| 6 | Bank of America | 3349.42 | US |

| 7 | HSBC | 2919.84 | China |

| 8 | BNP Paribas | 2867.44 | France |

| 9 | Mitsubishi UFJ Financial Group | 2816.77 | Japan |

| 10 | Credit Agricole | 2736.94 | France |

| …20 | UBS | 1717.25 | Switzerland |

The figures are based on S&P ranking as on April 2024 on the basis of Assets of the Banks- Source- Wikipedia. SBI with assets of 780.05 billion USD stands at 47th rank. HDFC Bank ranks 74th in the list.

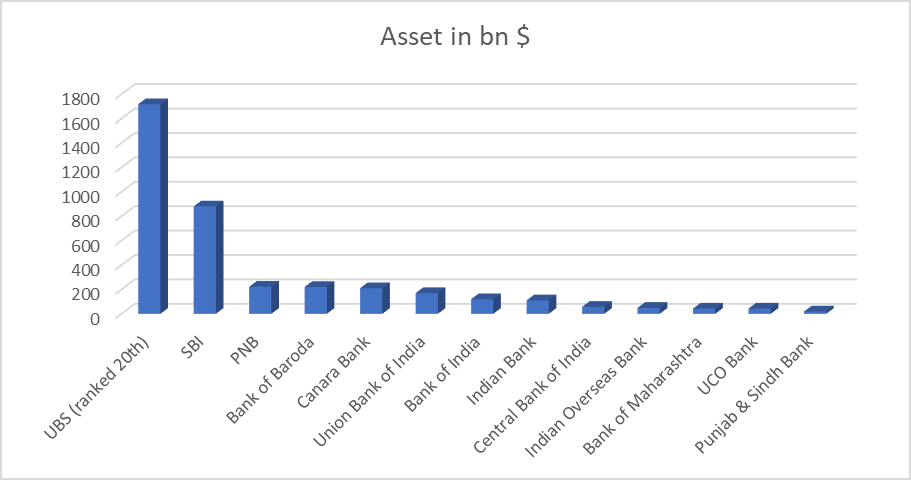

Asset wise ranking of Indian Public Sector Banks (on the basis of assets as on 01.08.2025). Source – Wikipedia

| Rank | Bank | Assets in INR cr | Converted to $ billion |

| 1 | SBI | 7,444,291 | 880 |

| 2 | PNB | 1,873,715 | 222 |

| 3 | Bank of Baroda | 1,839,671 | 220 |

| 4 | Canara Bank | 1,777,792 | 210 |

| 5 | Union Bank of India | 1,497,882 | 170 |

| 6 | Bank of India | 1,056,425 | 120 |

| 7 | Indian Bank | 895,503 | 110 |

| 8 | Central Bank of India | 481,186 | 57 |

| 9 | Indian Overseas Bank | 414,113 | 49 |

| 10 | Bank of Maharashtra | 367292 | 43 |

| 11 | UCO Bank | 362361 | 43 |

| 12 | Punjab & Sindh Bank | 161528 | 19 |

Here we can see the large gap in ranked 20th, UBS Bank and our Banks. If all banks are merged into one including SBI, we can be somewhere around number 20th. However, that is not a feasible step and hence merger of a few banks is expected resulting into remaining 3-4 banks. These banks may find place under 100th ranks. As target is 2047, our banks and the largest shareholder i.e Government may take a few steps to step up to the Global size. Why only number 20, why not in top 5?. I say top 5 because target year is 2047 and many organic changes can be affected to go to that league. We may look for following changes to step up the asset size of banks:

Geographical reach:

Top banks are having a vast geographical reach. Our banks should also venture into different countries after a well-researched study. Even Government or RBI can get the research conducted by an international agency and identify the countries and the niche where our banks can function. This will enable our banks to increase their customer base internationally and improve upon business.

Sovereign Rating of the Country:

India is rated BBB by S&P and lowest investment grade rating by Moody’s and Fitch, it is very difficult to compete with global players. All top banks are backed by much better credit rating of their countries. US is rated AA+, France AA-, China A+ etc. In any international market banks from a high rated country will get the funds at lower rates and our banks with lowest investment grade rating will not be able to generate high quality assets in foreign lands. We must work upon the factors that may help rating agencies to revise country’s rating upward. This will result into efficiency and more productive bank operations.

Quality of Assurance Function:

Assurance function i.e., Audit, Compliance and Risk Management are expected to be robust in global markets. As such when we expect to grow, these functions will have greater role to play. Banks need to stress upon automation and professionalism in these functions. Regulators in developed nations keep a strong vigil on these functions. With large size and diverse operations, the strength of these functions will avoid frauds and disruptions in business.

Investment Banking & Project finance:

Investment Banking is one of the major activities of these large banks and our banks stands nowhere near their ability and resources. We need to build resources for investment Banking that can attract sizable assets for our banks. Even portfolio management can also be carried out along with Investment Banking. Portfolio management will not directly contribute to asset building but it will add to the bottom line strengthening the banks financial status. Further, the big assets are locked with Project financing. Truly speaking, none of the Public Sector Bank is equipped to handle really big projects at international level. SBI may deliver some strength on this front but other banks have to really think about this area of function if we want to grow big and effective.

Islamic Banking:

Islamic Finance has grown to approx. 4 trillion USD, spread in around 80 countries. All big banks who are in retail arena offer IB products to cater to the need of all their customers. Indian Banking is yet to take guard on this front despite having market within the country. A global bank needs to have global products. Here the Government may have to effect a few changes in the Banking Regulation Act and other provisions to pave way for interest free banking, that is the basis of Islamic Banking. Venturing into such area will give a flexible and inclusive image to Indian Banks apart from increase in business and assets.

Revamping the structure of Board:

Board of Directors in a sizable bank must have professional directors from various fields. In addition to that a few directors who have considerable international exposure also should be a part of Board of the Bank. This will bring the required expertise and vision at the top who can guide the Bank to act globally.

These are a few gaps that Government and Bank Management should consider filling. Establishing resources and attaining a competitive edge will require years to our banks and policy makers. However, if we are able to cross these hurdles, we can surely move into the elite category of top banks. Consistent 5+ growth rate in GDP and size of our economy will act as catalyst to the above efforts. However, I must admit that our target should be to become effective, smart, inclusive, robust and trusted in all strata of the international customer base, the size will come automatically. Quality will lead to quantity.

Discover more from At Silly Point

Subscribe to get the latest posts sent to your email.

Heya i’m for the first time here. I found this board and I find It really useful & it helped me out a

lot. I hope to give something back and aid others like you

aided me.