BLOG 6/2026 DATED 20TH JANUARY 2026

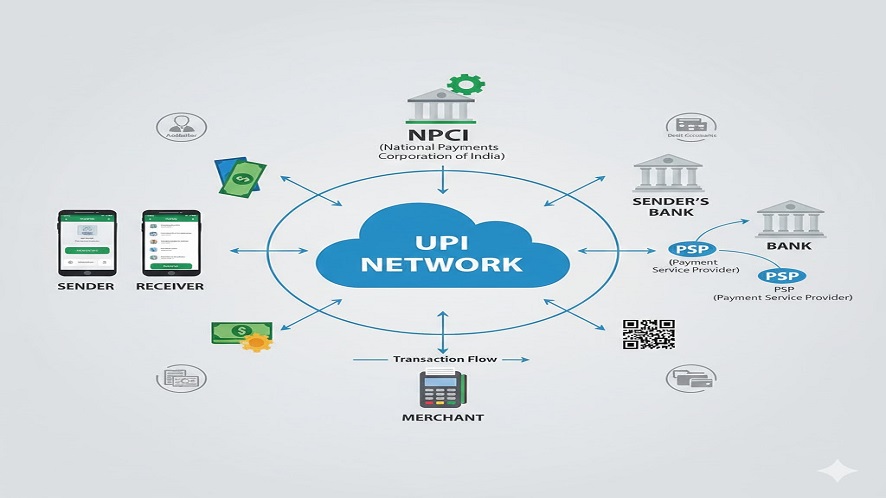

Pick the Mobile Phone, click a maze look alike figure, give your password, approve and you have transacted a financial transaction. The person receiving the money can be a taxi wala, vegetable vendor, shopping mall or a ticket counter. No cash counting, no problem of change, no carrying a bulky purse, no plastic cards. This is progress to the next level. The system that carries this seamless financial transaction with immediate settlement is called UPI (UNIFIED PAYMENT INTERFACE) developed by NPCI (National Payment Corporation of India). Such system of digital payment is first developed in India and implemented in 2016. This was first in the World, other countries including US, Japan etc followed subsequently.

The story of UPI:

| Timeline | Action |

| 2009 | RBI established NPCI, to enhance and streamline the Payment Systems in India especially digital payments. |

| 2012 | RBI issues a 4 years vision statement to digitalize the payment systems. |

| 2016 | A new system developed by NPCI called UPI launched for the public use. |

| 2018 | UPI 2.0 launched with linking overdraft accounts also with UPI |

| 2019 | Google suggested US to start a UPI like system naming FEDNEW. |

| 2020 | India became the country with highest number of annual transactions with 25.5 bn transactions. (As per ACI Worldwide) |

| 2022 | Credit Card transactions also linked with UPI. |

| 2024 | UPI 3.0 launched |

Present status:

Introduction of UPI has revamped the face of digital transactions in India as well as around the world. The ease of transaction, time saving, safety, UPI fits on all the fronts. During 9 months ending December 2025 (April – Dec) total UPI transactions in India are valuing INR 2.30 lakh crore, while total number of transactions during the period are 17687 crore. Per transaction value works out to Rs.1297/-. This shows that there are huge number of low value transactions, happening through UPI, taking technology to every nook and corner of the country.

Many other countries have adopted the NPCI model of UPI to facilitate their digital transactions. Since 2020 India is amongst the leading nations as far as digital payments are concerned.

As per statranker.org India stands at 54th rank in % of digital payment share in consumer transaction with 87.20% digital payments. Sweden stands at no 1 with 99.20%. However, for a country as huge as India, reaching a figure of 87% is no less an achievement.

IMF, in its report on Growing Digital Payments has said that India makes payments faster than any other country.

“UPI now processes more than 18 billion transactions per month and dominates other electronic retail payments in India. India now makes faster payments than any other country”

-IMF

According to another report the UPI covers 50% of all digital transactions of the world. Clearly UPI has dominated the other mode of payments, primarily due to its ease of operations. Within India, it covers 85% of all the digital transactions. UPI system of India has been adopted in 7 countries viz UAE, Singapore, Nepal, Bhutan, Sri Lanka, Mauritius and now Franch.

DOES NPCI AND ITS TEAM DESERVE AN INTERNATIONAL AWARD?

https://www.elibrary.imf.org/view/journals/063/2025/004/article-A001-en.xml

https://www.npci.org.in/product/upi/about-upi

Discover more from At Silly Point

Subscribe to get the latest posts sent to your email.

Definitely, one of the biggest achievement of India’s whole history. It shows how much talent India have in it. If system and the people can work together and honestly, we could become the greatest nation to ever exist.

It’s beautifully explained and covers almost all the important events of how we started the Digital India initiative and where we stand today. Still, a lot remains to be done. As far as digital payment is concerned, China is much ahead of us with their WeChat palm payment system, where even a mobile isn’t required – just a finger or palm scan suffices for payments. In this cutting-edge age of technology, we still stand at the threshold. There’s a lot more to be done… However, what we are doing is appreciable – we are moving in the right direction. At this point, we Indians need to accelerate our pace a bit faster. 😊

Ravi🙏

yes I agree.